Looking to take the big step and move out on your own? I mean, you can’t stay in your parents’ basement forever, right? Well…some people do, but I’m not so sure you want them as role models.

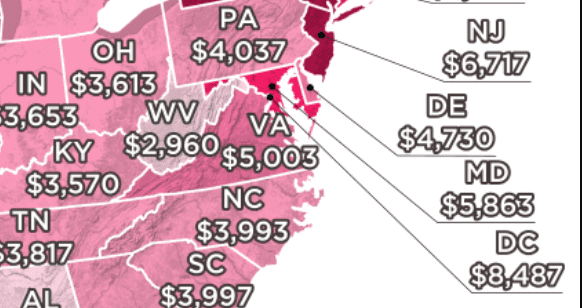

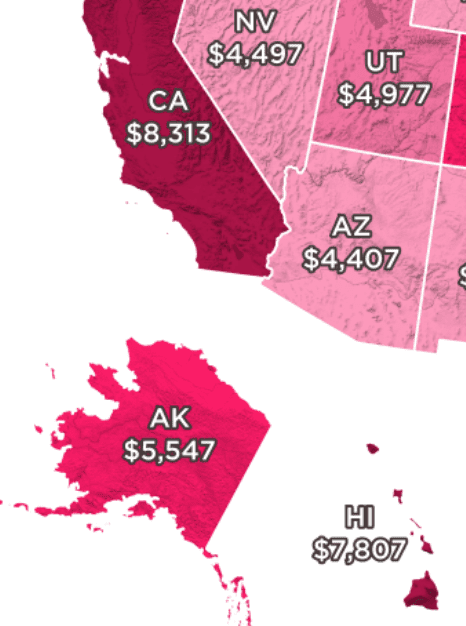

HowMuch.net recently put together an interesting infographic that shows just how much income you need to rent a house in every state. Needless to say, it might be time to ask for a raise.

(Click the image to expand)

Photo Credit: HowMuch

Based on research data from the popular housing website Zillow, HowMuch calculated the average price of rental property in each state. The final number shown on the map is based on the rule that housing costs should not exceed 30 percent of net income. Whether you are a math whiz or not, it does not take a genius to figure out that renting a home takes a whole lot of cash.

Though the map does not take into account variances by city, there are some eye-popping numbers that will also have your bank account cringing with fear.

Photo Credit: HowMuch

Care to rent a home in the nation’s capital? To nab the average rental property, you’ll need to make nearly $8,500 per month. Good luck having anything left over for furniture.

Photo Credit: HowMuch

Other pricey states for housing rentals include California ($8,313), Hawaii ($7,806) and New York ($7,223). I don’t know about you, but at that price living at home is starting to sound a lot more appealing.

Depending on your location and finances, it may even make sense to buy rather than rent. It’s important to do your research and crunch the numbers before you plunge into the housing market. Then again, maybe spending another year down the hall from mom and dad isn’t so bad after all.

The post Here’s What Monthly Income It Takes to Rent a House in Each State appeared first on UberFacts.