This ma is living the dream. Ed Sheeran has all the money he could ever want, and he’s been using it to slowly buy up all the property around his farmhouse in Framlingham, England, supposedly to build himself a “mini-village.”

That sounds like paradise to me. No neighbors, no hassle, no problems.

No.6 went #1 today and Beautiful People went #1 in the singles chart, which makes it the second #1 from this project….

Posted by Ed Sheeran on Friday, July 19, 2019

And by “buying up all the property,” I mean buying OUT his neighbors. Sheeran bought a farmhouse and some land around it in 2012 for just over $1 million (we’re talking US currency here). He then bought the house next door for about $550,000. Fast forward to 2016 and Sheeran purchased another nearby house for $1.1 million. The following year, the singer dished out $640,000 for a bungalow across the street.

Not only is Sheeran buying these properties, but he’s putting a lot of work back into them and the house he originally purchased. Sheeran was granted permission to build a kidney-shaped pool on the condition that it would also be a natural habitat to attract wildlife, but his plans for the pool got his neighbors peeved.

Ed Sheeran's home in Framlingham, Suffolk.

Posted by Realty One on Monday, January 29, 2018

Neighbors were annoyed when Sheeran placed hay bales around the pool to block neighbors’ views, and they accused him of using the water for recreation instead of a wildlife attraction, as originally decided. His neighbors have also complained that the famous singer has plans to build a giant treehouse and a chapel on his property.

So, what to do? Drop some cash on ’em, of course! Then no one can complain! And that’s exactly what Sheeran continues to do. Because he can.

Today the Divide tour broke the all time tour record set by U2. It's now the most attended and highest grossing tour of…

Posted by Ed Sheeran on Friday, August 2, 2019

When you have that much cash, you can pretty do whatever you want, whenever you want.

Now I need to get busy designing my own compound…

The post Ed Sheeran Has Spent Millions Buying Houses and Property from His Complaining Neighbors appeared first on UberFacts.

(@pnwLeftist)

(@pnwLeftist)  Tuition costs at public universities : 183%

Tuition costs at public universities : 183%

(@IdalinBobe)

(@IdalinBobe)

(@darth)

(@darth)

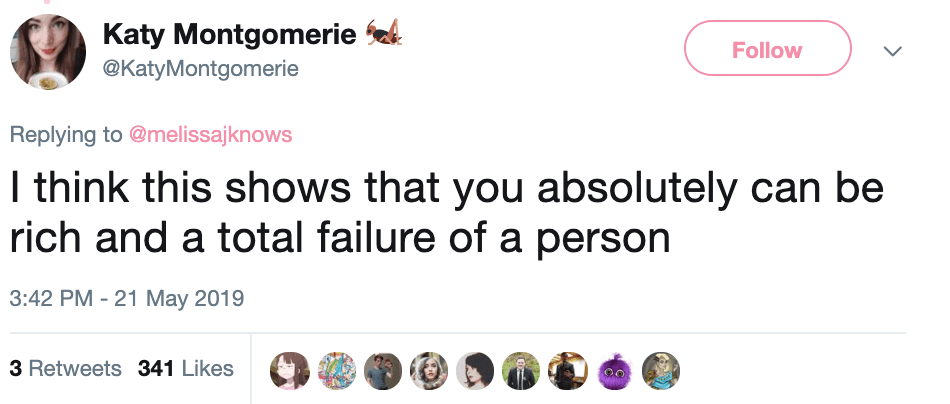

: @oliviafrances143

: @oliviafrances143