Five out of the ten richest counties in the United States are located in the suburbs of Washington D.C., within Maryland and Virginia. These counties boast a median income of approximately $134,000. Furthermore, when considering Washington D.C. alongside the fifty states, it holds the highest proportion of individuals with a college degree. Moreover, D.C. is a hub for a vast array of federal government and agency roles, inclusive of contractors. The jobs generally tend to pay well.

People Divulge Their Best Passive Income Sources

Not all of us make enough money from our jobs to survive. That’s why the side hustle, a means of making money alongside one’s main form of employment or income, has become such a thing.

Everyone seems to have one! But you know the saying, “Work smart, not hard,” don’t you?

That’s ideal… but first you have to figure out what to do and how to do it in such a way that you don’t compromise your main source of income. Oh, and hopefully it’s steady enough that you don’t have to worry yourself too much (or devote too much time to it)!

People told us all their tips and tricks after Redditor Kenneth0233 asked the online community:

“Smart people of Reddit, what are your best ideas for passive income?”

“I’ll give you a serious answer…”

“I’ll give you a serious answer, that did me well. Goes for people learning or that know a second language.”

“Find some public domain books, translate them. You now have rights over the translation. Get it into a library. Profit.”

“Works really well if you’re from an obscure part of the world undergoing political turmoil (Georgia, Armenia, Ex-Yugoslavia) that has been talked about in the media the past 30 years. University students will need primary sources, and there is a lack of supply.” ~ AjdeBrePicko

“Put ads on your car.”

“Put ads on your car. A friend has a large sticker on their passenger side door for a local business and they give him $100 a month to just have it there.” ~ fraxinnus

“Put 15 percent of earnings…”

“Learn to manage your finances and avoid debt.”

“Always be judicial with loyalty to any employer. Blind loyalty can bite you in the ass. If times get hard you are expendable. If you get a different offer of employment don’t reject it out of current loyalties but do weigh your options.”

“Put 15 percent of earnings into investments. An easily obtained seven percent yearly average will double your input in 20 years. 40 years would be near 5 times the principal.

“More aggressive investments could be much higher. 12 percent is a reasonably attainable average and the same 40-year investment would be over 18 times the principal. $400 per month for 40 years at 12 percent will net you $3.5 million on a $200 K investment.”

“Don’t underestimate the power of compound interest. When your money makes money is when true wealth happens.” ~ Birdapotamus

“If you have a bunch of cash…”

“If you have a bunch of cash, the best vehicle for passive income is and will almost always be municipal bonds in the state where you live. Federal tax-free, almost always state income tax-free, and will net you a pretty good chunk of cash if you find the right bonds.” ~ betterthanamaster

“Buy a partnership in a business…”

“Buy a partnership in a business that is already managed. You can be a passive partner in the business, but there are some rules that apply to passive partners that don’t apply to regular partners that can make this a headache, especially if the business losses money.” ~ betterthanamaster

“Not exactly passive…”

“Not exactly passive, but very low effort: house sit. I live in a decent area, near a good-sized city with affluent suburbs.”

“I get paid for basically hanging out, keeping an eye on the place, and taking care of a few pets, which to me is enjoyable, since I love animals and can’t have them where I live. I always choose places that are convenient for me to get to and also to commute to my job.”

“I house sat as a favor to a friend of a friend, and she gave me great references and recommended me to other people in her fairly affluent circle. I end up house sitting quite a lot at certain times of the year, and in really nice places. This might not be NO effort, but it sure as hell doesn’t feel like work.” ~ saltygirltarot

“If you’re artistic in any manner…”

“If you’re artistic in any manner, digital files you put to a marketplace are a good way to make a small side income. Though usually if you are artistically inclined you’ll also spend money on the hobby and so the first few years your income will probably be put straight back into it.” ~ Daelis

“Buy real estate.”

“Buy real estate. You can use tons of low-interest debt to buy it, you get depreciation and other tax benefits, and your tenants will pay off your mortgages and build up your equity in addition to giving you cash flow.”

“There are lots of good strategies, but no need to reinvent the wheel. This one works for dumb and smart people alike.” ~ [deleted]

“Educate yourself…”

“Educate yourself and don’t be afraid of work.”

“If you’re handy, look into real estate. If you’re techy there are ways to invest in dropshipping or Amazon affiliate businesses. If you’ve got the money you can afford to lose look into paper investments and crypto.”

“If you’ve got money you can’t afford to lose but don’t need for a while, look into bond ladders. In the end, educating yourself will pay bigger dividends than asking someone else what to do and nobody can tell you what your risk tolerance or work ethic is.” ~ yanbu

“Pay someone to manage it…”

“Own property and rent it out. Pay someone to manage it for you for a small percentage of your profits and/or in exchange for living there.” ~ [deleted]

“I check for smaller businesses…”

“I check for smaller businesses struggling with their websites/non-existent websites, create one that seems to be fitting for their apparent type of line, and market it to them – if they seem to be fine with it, I give them a contract to pretty much rent the website.”

“A lot of active work goes in, but fairly priced it will pay well in a long run.” ~ lymdyxdx

And there you have it.

If you want to make some money, you’ll have to spend some money.

And some forms of passive income also requite some amount of active work to get going.

So what are you waiting for?

Go make that coin!

This Couple Thinks $500,000 a Year Makes Them ‘Average’, so the Internet Took Them to School

These folks think they’re just “average”. If this is average then a lot of us are in big trouble. This story comes from an anonymous New York City couple. They have two children and make a combined $500,00 a year, and they broke down their expenses for all to see.

Oh yeah, and they feel “average”.

Here is the breakdown for you to mull over (and likely be jealous of).

Here's a budget breakdown of a couple that makes $500,000 a year and still feels average. https://t.co/mauqIGvcRw pic.twitter.com/eh7xBwvMV1

— CNBC (@CNBC) March 26, 2019

Those numbers, to most people out there, are pretty insane and totally unrealistic. The actual average household income in the United States in 2017 was $61,372, just to give you an idea of what we’re talking about here.

Predictably, people on the Internet mocked these “average” people relentlessly.

imagine being able to put away $36,000 in a 401k every year that is more than two annual federal minimum wage jobs https://t.co/TDJpe4sqwW

— darth

(@darth) March 26, 2019

anyways

having $7k at the end of the year would probably feel pretty great to a lot of people— darth

(@darth) March 26, 2019

Average people don't have the ability to contribute 18k a year to charity either

— ODS (@brendan_schleen) March 26, 2019

Their house is $1.5 million, with $20,000 property tax payment. So average.

— KP (@lightsoutonight) March 26, 2019

This is an excellent point.

$9500 a year in clothes! What planet are these people on!

— Intricate Expanses (@Intricatexpanse) March 26, 2019

Oh man, is there a GoFundMe for these people?? I want to help out however I can

— Connor Wroe Southard (@ConnorSouthard) March 26, 2019

"feels average" *will have over 3 million saved in 401k by age 66* pic.twitter.com/T9i5dflvsO

— Michael Benson (@Michael__Benson) March 26, 2019

This was a big point of contention, too.

"three vacations a year" is really snuck in there

— Dana Schwartz (@DanaSchwartzzz) March 26, 2019

And finally, this guy put the cherry on top of the whole thing.

Exactly… And there are 129mm Americans that make less than $35k per year — 56% of Americans with income. This shows $36k in 401k contributions, $18k to charity, $10k misc with $7k left over. Those figures alone total $71k, more than double what most Americans make.

— Dan Connell (@dpconnell) March 26, 2019

If they’re average, I guess I must be a peasant…now I’m depressed.

The post This Couple Thinks $500,000 a Year Makes Them ‘Average’, so the Internet Took Them to School appeared first on UberFacts.

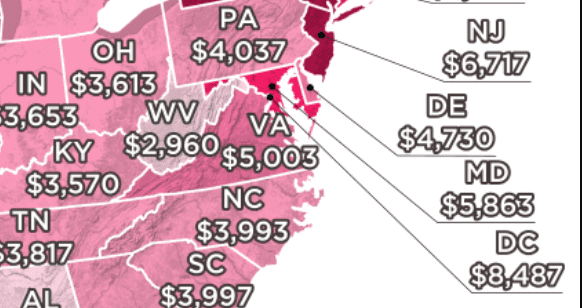

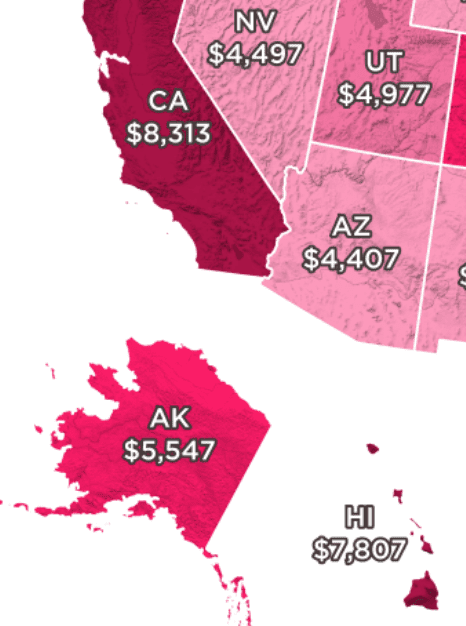

Here’s What Monthly Income It Takes to Rent a House in Each State

Looking to take the big step and move out on your own? I mean, you can’t stay in your parents’ basement forever, right? Well…some people do, but I’m not so sure you want them as role models.

HowMuch.net recently put together an interesting infographic that shows just how much income you need to rent a house in every state. Needless to say, it might be time to ask for a raise.

(Click the image to expand)

Photo Credit: HowMuch

Based on research data from the popular housing website Zillow, HowMuch calculated the average price of rental property in each state. The final number shown on the map is based on the rule that housing costs should not exceed 30 percent of net income. Whether you are a math whiz or not, it does not take a genius to figure out that renting a home takes a whole lot of cash.

Though the map does not take into account variances by city, there are some eye-popping numbers that will also have your bank account cringing with fear.

Photo Credit: HowMuch

Care to rent a home in the nation’s capital? To nab the average rental property, you’ll need to make nearly $8,500 per month. Good luck having anything left over for furniture.

Photo Credit: HowMuch

Other pricey states for housing rentals include California ($8,313), Hawaii ($7,806) and New York ($7,223). I don’t know about you, but at that price living at home is starting to sound a lot more appealing.

Depending on your location and finances, it may even make sense to buy rather than rent. It’s important to do your research and crunch the numbers before you plunge into the housing market. Then again, maybe spending another year down the hall from mom and dad isn’t so bad after all.

The post Here’s What Monthly Income It Takes to Rent a House in Each State appeared first on UberFacts.